Invoicing is one of the major parts of running any business, whether you offer freelance services, have an e-commerce store, or run a small contracting business in Australia. Without invoices you won’t get paid – they are pretty important!

Why should your business use invoicing software?

Let’s face it creating invoices, sending them to clients, and following up on unpaid bills is a pain. Not only that, but manual invoicing is super expensive and time-consuming

(according to reports, the average company takes around 25 days to manually process a single invoice from receipt to payment).

Invoicing software for small businesses provides an excellent alternative.

How to choose the Best Invoicing software for your business?

Before you choose an invoicing tool, you should ask yourself questions like:

- What is your goal? What are you trying to achieve by using invoicing software?

- What are the features you need from your invoicing software?

- What is your budget?

- Are you looking for a simple invoicing app or a more advanced invoicing solution with features like payment processing, recurring invoices, and expense tracking?

Every invoicing software is different and offers unique features. Make sure the invoicing software you choose meets the needs of your business and your clients – after all, they are the ones paying your invoices.

Invoicing tool should make it simple to create estimates and invoices, send them to your clients, and get paid on time. Additionally, invoicing software can include many other helpful features such as tracking expenses or processing payments.

But with 100s of invoicing tools in Australia to choose from…

…which one is the right for you and your business? Or you just want to use Free invoice generator for Australian small business?

We set out to compare the top 10 Invoicing Tools to help you find the one that fits your needs best.

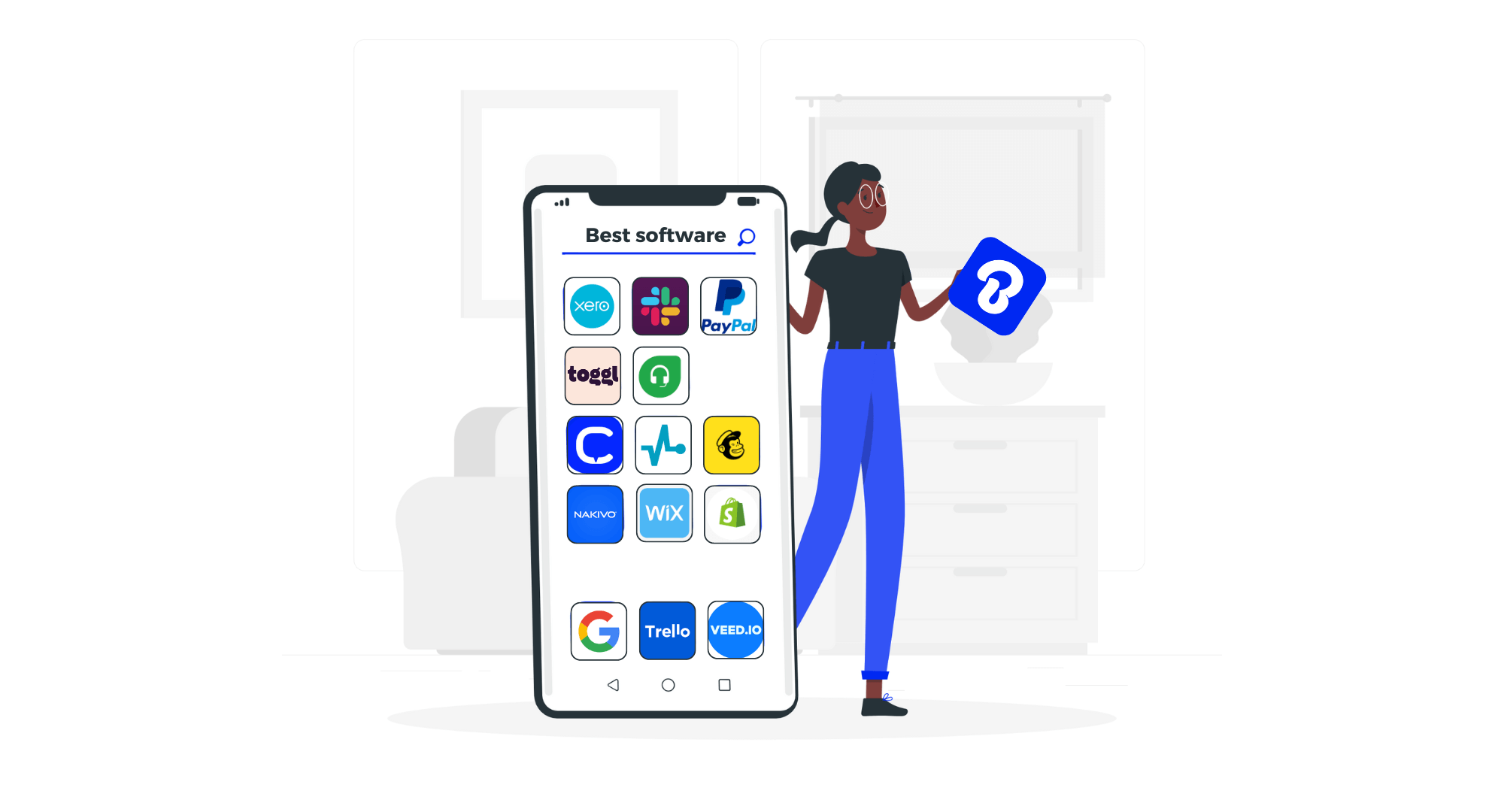

Top Invoicing Apps in Australia

Invoicing software | App Store reviews | Free version | Pricing |

Billdu | 4.8 out of 5 (20,8k) | YES | $4.99 – $19.99 |

Invoice Simple | 4.8 out of 5 (15,6k) | YES | $4.99 – $19.99 |

SquareUp | 4.8 out of 5 (10,8k) | YES | $29.00 – Custom |

Zoho | 4.8 out of 5 (7,1k) | YES | Custom |

Wave | 4.4 out of 5 (6k) | YES | $16.00 |

Xero | 4.6 out of 5 (1,1k) | YES | $29.00 – $62.00 |

Invoicera | – | YES | $15.00 – $119.00 |

Myob | 4 out of 5 (150) | YES | $5.00 – $88.50 |

Invoice2go | 4.8 out of 5 (49,5k) | YES | $5.99 – $39.99 |

Rounded | 4.4 out of 5 (100) | YES | $23.95 – $29.95 |

#1 Billdu – Best Rated Invoicing App

Billdu is our top pick for invoicing software for a variety of reasons. It offers businesses simple-to-use invoicing software with a wide range of other features to turn your payment and invoicing experience into a simple and fast process.

Let’s take a look at its features and pros.

Billdu main features:

- Create, edit and send invoices, estimates, quotes and other documents in seconds

- Professional-looking, customizable invoice templates to wow your clients

- Instant payments

- Automatic payment reminders

- Recurring invoices

- Expense tracking

- Read and open notifications

- Invoice/payments tracking

- Receipt scanner

- Financial reporting

Main advantages of Billdu:

- Unlimited invoices on all paid plans.

- Helping you to get paid faster (up to 9 days!) by accepting credit card payments.

- Enable instant payments as soon as the job’s complete.

- Always know which invoices are paid and which are overdue with invoice status tracking.

- No need to chase late payers manually one by one anymore, thanks to Automatic payment reminders.

- Invite your accountant and make tax season a bit less stressful.

- Works on any of your devices, even on the go – with an easy-to-use mobile app.

- Your data is always synced and secure, anywhere and everywhere you need it.

Billdu plans and pricing

Billdu offers 4 plan options to fit the invoicing needs of any business.

- 30 days free trial– allows you to use all invoicing and reporting features

- Lite plan for just $4.99. offers unlimited invoices, up to 10 clients, and invoice status tracking.

- Standard – $9.99. With unlimited invoices, estimates, and appointments, up to 50 clients, and payment reminders.

- Premium plan – $19.99. Gives you unlimited clients, 10 users, up to 5 manageable businesses, recurring invoices, and a lot more.

For more details on all pricing plans and features, visit the pricing page.

Billdu reviews

Billdu is one of the best-rated invoicing apps on the market. It has over 20 000 4.8 out of 5 reviews on App Store. Putting its Trust Score rating into the Excellent category.

Billdu offers everything you would need from invoicing software at an affordable price. Its easy-to-use mobile and web app, great reviews, and responsive customer support make it the best invoicing tool for businesses in Australia.

You can try Billdu now with a free 30-day trial without adding any payment details (no credit card needed).