A solid payment system for a business is like fuel for a rocket. Without it, you won’t grow and expand. And that’s why we prepared a comparison that describes 6 payment processing companies, their features, pros, cons, and pricing.

As a small business, you need a system that’s reliable and secure. After all, your customers (often, located around the globe) want to be sure their online transactions are safe and sound. So, let’s explore some of the best options to make sure your business can accept payments and grow trust among customers.

Why SMBs need better Payment Processing Providers

Today, most transactions happen online, so having a reliable payment processing provider is an essential component of your stack. Fraud is on the rise, which is making some consumers hesitant to share payment information or make online payments.

The right payment processor takes care of everything to ensure smooth transactions, including protecting your customer data and processing refunds. Without a solid payment processing system, online transactions would be risky, unreliable, and prone to fraud. And that’s the last thing you’d like to have as a business, right?

So, diving in, let’s discuss first how exactly payment processing works and what are the key features of such systems.

How Payment Processing Works

Online payments are everywhere, so there’s a good chance you already have some familiarity with how they work. But do you know what happens inside the payment processing system?

Let’s review all the steps and what happens at each stage:

- The customer makes the purchase

- The customer enters their payment information, such as their credit card number, into the payment processing provider’s system

- Provider authorizes the transaction by verifying the customer’s payment details and checking for available funds

- The processor and merchant get a response

- The transaction gets authorized and after that, the system sends money from the customer to the merchant

- Funds are placed on hold for a short period to ensure that the transaction is not fraudulent

- If everything is ok, funds are transferred to the merchant’s bank account

- A payment processing provider charges a fee for their services (% of a transaction amount)

As you can see, there are quite a few steps and verification requirements considering it’s just one payment flow. Which is why it’s important to make sure you have the right features.

Key Features of Payment Processing Providers

Do you really need to worry about all the features in your payment processor? I mean, if the payment clears and your customers are happy does it really matter? The truth is, there can be a wide range of features related to UX and security. Finding one that fits your needs without overcharging (for features you don’t need!) is crucial.

Here are the basic features all SMB payment processors should have:

- Security measures like compliance with Payment Card Industry Data Security Standard (PCI DSS), Transport Layer Security (TLS), and similar

- Recurring payment option, support for various credit and debit cards

- Analytics capabilities that let you track how many transactions went through, and failed, what are the trends and customer behavior

- Integrations with other tools in your stack (or via integration tools) that let you automate the payment flow

- Optionally, other features like invoice management.

At the end of the day, it depends on what your business needs. Gather requirements from teams within your company so that when the time to choose comes, you know which provider shines.

Evaluating Payment Processing Providers

When choosing your next payment processing provider, it’s easy to get overwhelmed. There are dozens of options–and all are claiming to be the best. Take a deep breath and keep these factors in mind when evaluating payment processing providers:

Security and Fraud Detection

You don’t want to put your reputation at risk because of a sketchy payment system. Thus, make security your top priority when choosing a provider.

Things like strong encryption capabilities, fraud detection, and security certificates are good signs that the provider you’re considering is reliable. For example, fraud detection tools like address verification and CVV matching can save you a lot of headaches going forward because the system will detect sketchy transactions.

On the other hand, strong encryption will ensure customer’s personal data is safe throughout the payment process.

Pricing and Fees

Being a small business means you need to keep a close eye on your budget. And considering you don’t want to overpay or go for enterprise solutions, pricing is another important factor for you (or at least for your accountant, right?)

A pretty common approach to pricing is the following:

- Pricing is based on flat-rate fees

- Pricing tiers that start with a basic feature set

- The interchange-plus pricing consists of an interchange fee plus the markup of a credit card processor

Flat-rate pricing is pretty straightforward — you pay the same fee for all the transactions.

In tiered pricing, it depends mostly on the volume of transactions. So for example, if you have multiple small transactions, the pricing may get out of control pretty quickly.

On the other hand, interchange-plus pricing provides a lot of transparency as it’s based on two factors so you can separate processing fees from the interchange fees set by the card networks. To avoid surprises, compare transaction fees for credit cards, debit cards, and ACH transfers.

Integration Capabilities

We already mentioned the way your payment processing system ties together with other tools is pretty important. All in all, you don’t want to spend a lot of time figuring out how to set it up or investing in a tool that will require weeks for your dev to set up.

So look for providers that offer easy, no-code integrations with your accounting software or other financial tools you use daily. Also, keep in mind your website also has to tie well with the system—after all, it’s the central hub that fuels your business.

Ok, now that you have all the basics sorted out, see the comparison of six payment processing providers.

Top 6 Payment Processing Providers for Accepting Online Payments

To run an online business without a hassle, choose the right provider for accepting payments from customers. Remember, secure transactions, quick deposits, and easy integration with your website or app are pretty crucial here.

1. PAYPAL

Nobody needs an introduction to what PayPal is, right? As the most popular payment processing provider for online businesses, it’s trusted for most folks out there. To be more precise, they have 433 million active users worldwide. And did you know that customers are 2.8 times more likely to convert when they see that familiar blue logo? It’s all true!

While the numbers are pretty impressive, the most popular doesn’t mean the best. While it’s easy to set up, the chargeback fees are high along with currency conversion fees. Let’s see what features you can find on the platform.

PAYPAL FEATURES:

- Mobile payments

- Recurring billing

- Invoice creation and management

- Integration with popular e-commerce platforms, and CRMs

- Virtual terminal for card-not-present transactions

PAYPAL PROS:

- Intuitive and easy to set up

- Really safe and secure and include 2FA authentication

- Millions of online shoppers use it

- Integration with popular accounting software

PAYPAL CONS:

- Slow dispute resolution process

- Fees can get out of control for businesses with a high volume of transactions

- The commissions are high when you invoice clients directly through the platform

- Hold funds for new accounts or unusual transactions

- High fees for currency conversion and international payments

- High fees when withdrawing money to local bank accounts

PAYPAL PRICING

PayPal’s Pricing depends on the type of account and the volume of transactions. For individuals and businesses just starting out, PayPal offers a free account with no monthly fees. However, transaction fees apply for each payment received.

Summary of two pricing options:

- Standard, no monthly fees, 2.9% + $0.30 per transaction

- Pro, $30.00 monthly fee, 2.9% + $0.30 per transaction

Overall, PayPal’s biggest advantage is that it’s widespread and recognizable so a lot of your customers can expect that it will be available on your website. But, PayPal may cost you a lot if your business is growing fast.

2. SQUARE

Square is a popular payment processing provider that offers pretty affordable transaction fees and fast deposits into your account. What’s more, Square can equip your business with an invoicing and inventory management option.

Square integrates with a wide range of business tools, from Wix and QuickBooks to small business CRMs. They also have an API that’s easy to use by debs and they offer plugins for various websites.

SQUARE FEATURES:

Tons of features help you accept online payments. Some of the key features of Square for online payments include:

- Secure online payment processing service and remote payment flexibility

- Supports ACH, debit and credit card payments, and digital wallets

- Option to use the mobile payment device

- Offers data tracking like online sales, inventory, and customer trends

- Offers businesses to set up recurring payment schedules

- Offers invoicing capabilities

SQUARE PROS:

- No additional fees for international credit cards

- Affordable transaction fees

- Integrations with Acuity Scheduling, GoDaddy Websites and Marketing, Wix, WooCommerce, Jotform etc.

- No fee when a merchant issues a refund, the customer receives their full payment and the merchant receives the transaction fee in return

SQUARE CONS:

- Higher transaction fees compared to some other payment processing providers (but lower than PayPal)

- No 24/7 customer support

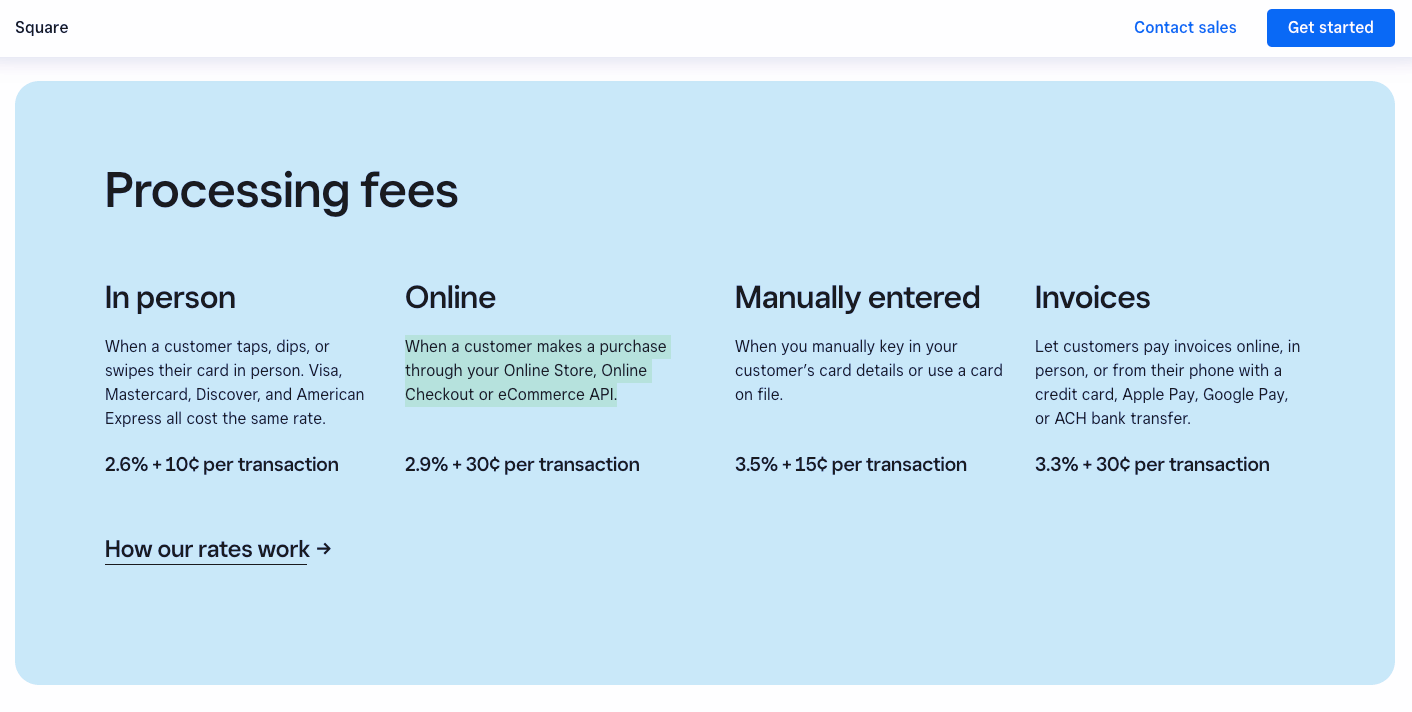

SQUARE PRICING:

Square’s pricing is transparent and pretty similar to other providers. As for online payments, they charge a transaction fee: of 2.9% + $0.30 per transaction but there are no monthly fees or hidden costs. If you choose to subscribe to Premium for $79/mo, the transaction fees will drop to: 2.6% + $0.30.

Square also offers additional tools and services for a fee, such as chargeback protection and instant deposits.

If you’re looking for a payment processing provider that’s rather simple to use and offers affordable fees, Square is something to consider. The biggest minus is a lack of 24/7 support that could help you in case something breaks (and payment bugs may have a serious impact on your bottom line.)

3. STRIPE

While not quite equal to PayPal in terms of recognizability, Stripe is a pretty popular provider with a wide range of features for online payments.

One cool thing about Stripe is that they’re focused on payment infrastructure only for internet transactions — this kind of specialization is a good sign.

Stripe has pretty low fees and supports a variety of payment methods, including credit cards, Apple Pay, and Google Pay. As with most systems, it integrates with most website and app platforms.

STRIPE FEATURES:

Stripe is well-known for its flexibility. It integrates with 300+ apps and platforms including Shopify and WooCommerce.

Stripe for online payments includes:

- Customizable payment forms and various payment methods like credit and debit cards, digital wallets

- Subscription management to manage recurring payments for subscription-based services (great for SaaS businesses)

- Mobile payments — they offer a native mobile library and SDKs for iOS and Android, so if you have a mobile app you can accept payments there

- Fraud detection and prevention and Payment Card Industry Data Security Standard (PCI-DSS) compliance

- Split payments

- Managing payouts to recipients

STRIPE PROS:

- Stripe has great security tools that prevent users from fraud

- User-friendly platform, easy to set up

- Flexible integrations, e.g. with Quickbooks

- Customizable payment forms

- Very good and unlimited customer support

STRIPE CONS:

- The price can get out of control when having a high transaction volume, as it charges a per-transaction fee

- Doesn’t support merchants well during chargebacks

- Takes a couple of days for payments to be deposited into a checking account (which isn’t ideal for businesses and its liquidity)

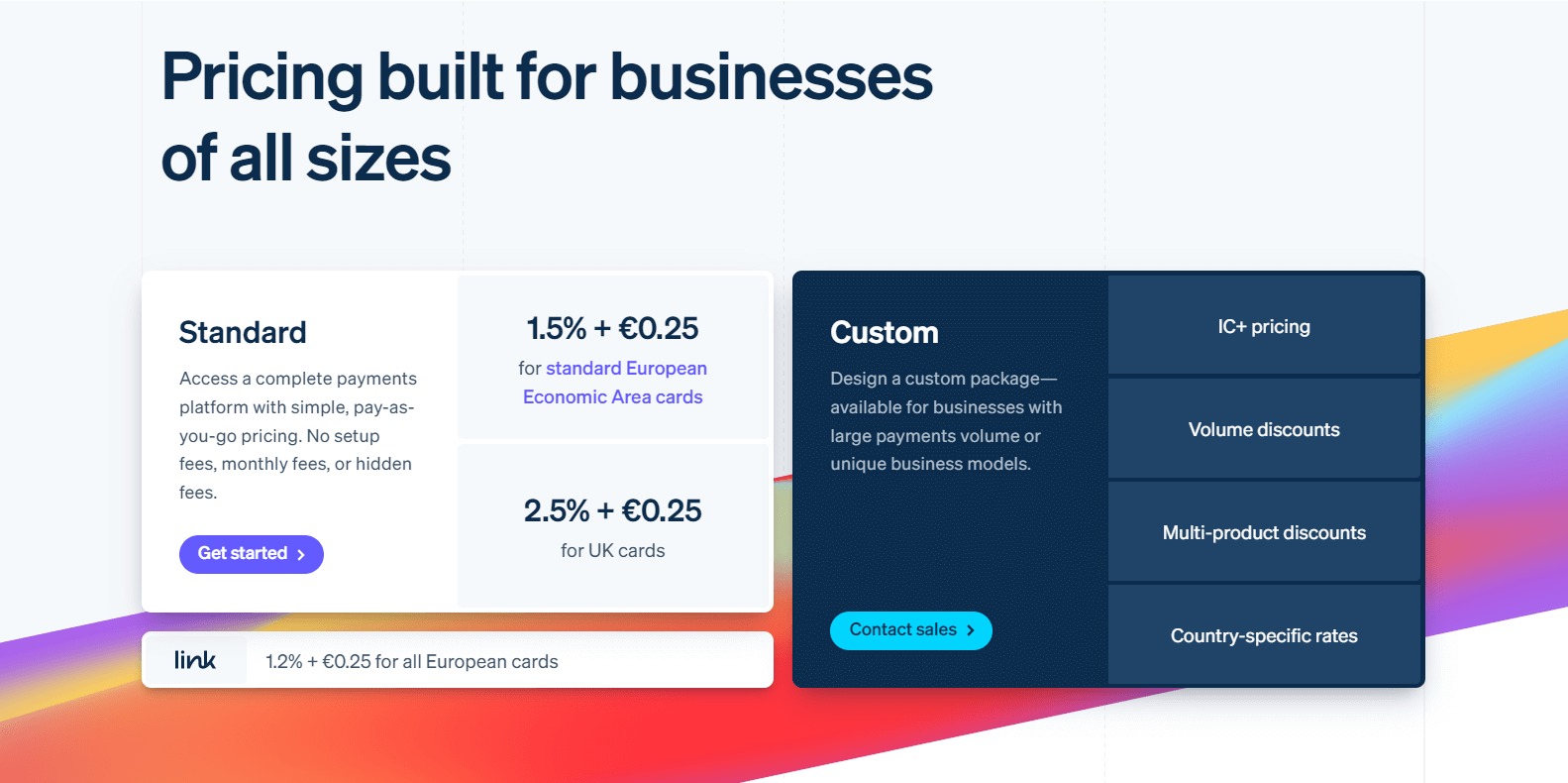

STRIPE PRICING:

Stripe’s pricing varies. For online transactions, they charge 2.9% + $0.30.

For standard European Economic Area cards they charge 1.5% + $0.30. And for international cards costs go up to even 3.25% + $0.30 (plus a currency conversion fee if needed.)

Overall, Stripe is a solid payment processing provider with a number of flexible integrations. As the platform’s checkout process is customizable, Stripe can be a good addition if you have a developer in a team that can set everything up.

4. AUTHORIZE

Authorize.net has over 20 years on the market (they’re a Visa company.) They offer a standard set of features including fraud detection, recurring payments, various integrations, and advanced reporting capabilities. They process Visa, Mastercard, American Express, Apple Pay, ACH transactions, and a couple more options.

Some users say their fees are a bit higher than some other providers, but in general, Authorize.Net is reliable and secure.

AUTHORIZE.NET FEATURES:

- Integrates with a variety of third-party applications, including popular shopping carts, or accounting software

- Offers a variety of fraud prevention tools, including address verification and a card code verification system

- Advanced reporting capabilities — detailed transaction reports, settlements, and chargebacks that make it easy to track and analyze payment activities

- Offers tools for businesses to set up and manage recurring payments for subscription-based services or memberships

AUTHORIZE.NET PROS:

- It’s easy to set up and use (even for non-tech people)

- No hidden fees or long-term contracts

- It has robust security protocols which help against chargebacks

AUTHORIZE.NET CONS:

- Supports only U.S., CAD, and eight European currencies (other providers have way more of those)

AUTHORIZE.NET PRICING:

Authorize.Net has the same transaction fees for online payments as other providers: 2.9% + $0.30. The one drawback is the $25 monthly gateway fee which makes it a more expensive solution compared to others.

If you choose only the payment gateway option, you’ll also have to pay a daily batch fee which is the assessed fee for a batch of transactions registered from the previous 24 hours.

In summary, Authorize.Net is considered by its users as a reliable and secure payment gateway, with a variety of features and third-party integrations. This payment processing provider is fairly easy to use and their customer service is reasonably available when needed.

5. PAYLINE

Off to another provider, this time we’ll talk about Payline.

They have a pretty flexible online and mobile payments solution that does not target any business size in particular. As with most payment solutions, they also take great care of security and reliability and accept various payment methods.

What’s cool is you can calculate your monthly costs based on the average transaction amount and average monthly volume.

PAYLINE FEATURES:

- Wide range of payment methods: credit and debit cards, e-checks (ACH), digital wallets, and more

- Secure and reliable payment gateway

- Integrations that include websites, e-commerce platforms, and other payment systems

- Supports recurring payments for subscription-based services (good solution for SaaS)

- Fraud and chargeback protection, compliance with Payment Card Industry Data Security Standard (PCI-DSS)

- Reporting and analytics, e.g., transaction data, reports, sales insights

- Online invoicing tools for streamlining the payment process

PAYLINE PROS:

- Very easy to use

- 24/7 phone support

- Easy integration with popular e-commerce platforms and shopping carts

- Competitive and transparent fees that are lower than the competition

- Flexible payment options for businesses of all sizes

PAYLINE CONS:

- Limited international payment options

- No support for cryptocurrency payments

PAYLINE PRICING:

Payline has transparent pricing for both in-person and online payments. About the latter, it’s 0.75% + $0.2 per transaction / $20 per month fee.

What’s more, they offer two pricing plans:

- PAYLINE SWIPE: $10 monthly fee, $0.1 per transaction fee, debit card 0.25%, credit card 1.71%, deposit time 1-2 days

- PAYLINE KEYED-IN: $10 monthly fee, $0.2 per transaction fee, debit card 0.35%, credit card 2.00%, deposit time 1-2 days

Overall, Payline is a solid choice for businesses looking for a reliable payment processing provider with competitive pricing and a range of flexible features.

6. PAYSIMPLE

The last payment processing provider I want to cover is PaySimple. They offer a variety of features, including free accounting software and integrated payment service. Their messaging mainly targets small businesses and startups but, surprisingly, they don’t disclose pricing (which tends to be more common for enterprise products.) Still, its features make it worth considering.

PAYSIMPLE FEATURES:

- Accept various payment methods, including credit and debit cards, e-checks (ACH), and recurring payments

- Recurring billing sends customizable invoices to customers, and provides options for accepting payments directly from invoices

- Supports mobile payments

- Reporting and analytics features, offering insights into sales trends, payment activity, and customer behavior

- Integrates with third-party tools and platforms, such as accounting software, CRM systems, and e-commerce platforms

PAYSIMPLE PROS:

- Good for subscription-based customers as it offers recurring billing and invoicing options

- Pretty easy to use

- Low rates for credit card and ACH payment acceptance

- Automated late payment follow-up

- Pretty good customer support

PAYSIMPLE CONS:

- No transparency with pricing and transaction fees (quote-based)

- Works only for the U.S-based businesses

- Limited integrations with other software

- No chargeback protection

PAYSIMPLE PRICING:

PaySimple is the only platform that doesn’t disclose its full pricing plan openly. G2 states that the pricing of PaySimple is 27% more expensive than the avg. payment gateways product.

In the SMB section on their website, they state they charge 2.90% per transaction + $0.3 monthly fee and 1.00% + $0.30 for ACH.

In general, if you’re looking for a suite that includes not only a payment processing system but also an invoicing tool, PaySimple might be a good choice (in terms of pricing, there will be a subscription-based fee for the whole suite.)

Which Payment Processing Provider should you go with?

As you see, there are many options to choose from on the payments market. Remember, each provider has both pros and cons, so it’s worth taking the time to discuss all the options with your team before making a decision.

Still overwhelmed? Here’s a handy guide to help you make the right decision:

- If you want a super recognizable provider, with an easy setup that supports many payments and you don’t mind higher transaction fees even for small transaction volumes, go with PayPal

- If you’re looking for an all-in-one solution with clear pricing and you need also hardware for in-person payments and you don’t mind a bit high transaction fees even for small transaction volumes, go with Square

- If you’re looking for a flexible option with recurring payments and great security options and you don’t mind dedicating your developer’s time, go with Stripe

- If you’re looking for a company that’s been on the market for a long time, supports various payment methods and recurring billing but requires a separate merchant account and is a bit more costly, go with Authorize.Net

- If you’re looking for a solid processing provider with recurring billing and strong security options, don’t mind dedicating your dev’s team time to connecting it via API, go with Payline

- If you’re looking for a payment processing and management platform that handles recurring billing and don’t mind the lack of payment transparency, go with PaySimple.

Begin Your SMB Adventure Empowered by Billdu!

Billdu seamlessly integrates with Stripe and PayPal, streamlining your transaction processes. Ensure secure and convenient payments for your SMB. Upgrade with Billdu today!