Invoice Template Australia

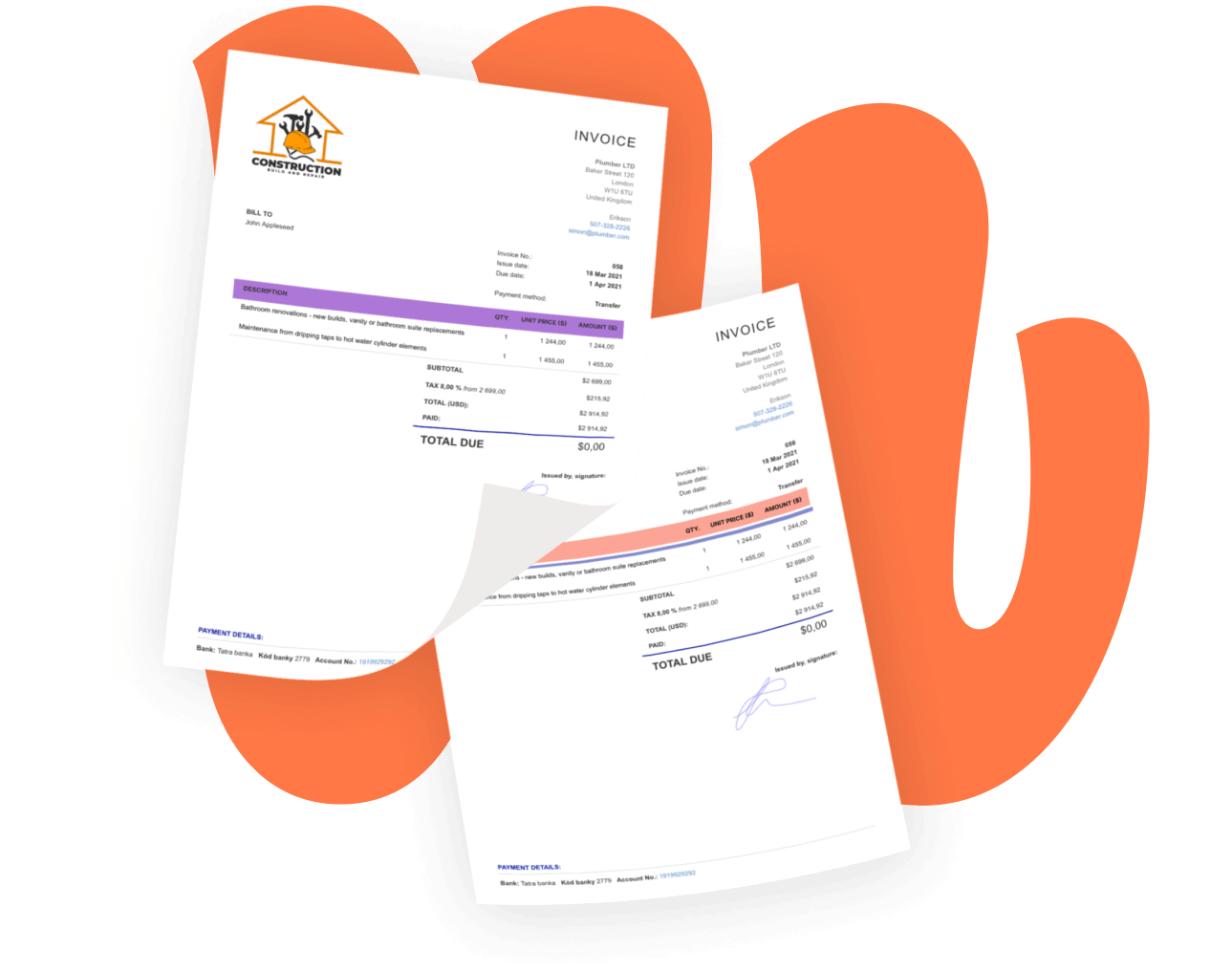

Use our free Australian invoice template to create invoices or tax invoices (incl. GST) for your Australian business

You do not need to spend time going through all the invoice templates available on the internet. We have created a free invoice forms that you can easily edit or download to your computer. Select your preferred format and start using the template now.

Professional invoice templates are not the only thing we offer. With Billdu you can grow business even more.

Create your invoice templates directly in our app and keep your documents at one place and access them whenever you like. You can try it out with 30-days free trial.

Add a Pay Now button to the bill template and get paid up to 9 days sooner by accepting payments from online payment services. Nothing cheers up more than a settled bill!

dashboard and documents

Don't limit yourself with invoices only. Create estimates, quotes, delivery notes and more. Keep the track with our dashboard that gives you the greatest comfort for operating and monitoring your business.

Simple Invoicing Platform for Freelancers and Small Businesses