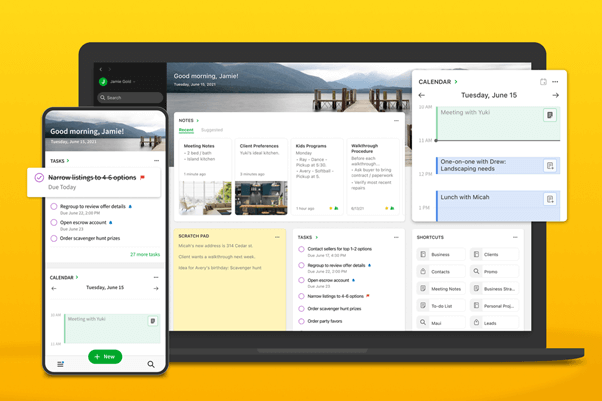

#7 Tmetric

Those looking for the best free business app can try Tmetric, a simple solution that makes it easy to log work hours. With this tool, you’ll be able to measure productivity.

While there is a free plan, we must mention that it comes with basic functionality for analyzing data, time tracking, and project management. The free plan lets users manage up to five users. You’ll need to upgrade to be able to handle bigger teams and enjoy more features such as payroll, time off management, and screenshot capturing.

The paid plan starts as low as $5 per month. You can use the web version of the tool or download it on your mobile device, computer. Moreover, there’s also a browser plugin.

The tool is available in multiple languages including English, Russian, and German. This makes it perfect for international users. Plus, it’s very intuitive and easy to use with the option to integrate with most project and task management systems for better activity and time tracking.

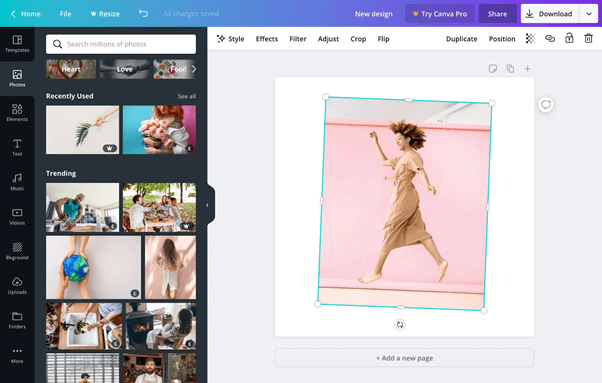

#8 Canva

Canva isn’t found on most productivity apps lists as it is more of a visual communication tool; however, it deserves a mention due to how feature-rich it is.

Those who work in the graphics department can understand how beneficial this tool can be. Designing a simple logo or writing text over pictures can take a lot of time. This app makes such tasks easier by giving users the option to choose from multiple fonts, templates, and designs so you can create content in no time.

Despite all this, the tool is free to use for individual users. However, for business purposes, get ready to shell out at least $12.95 per month.

It’s simple, easy, yet highly beneficial with the ability to create compelling designs in no time.

Said to be suitable for beginners, the tool can be used by pros as well. Some of its defining features include design grids, charts, badges and stickers, and photo frames.

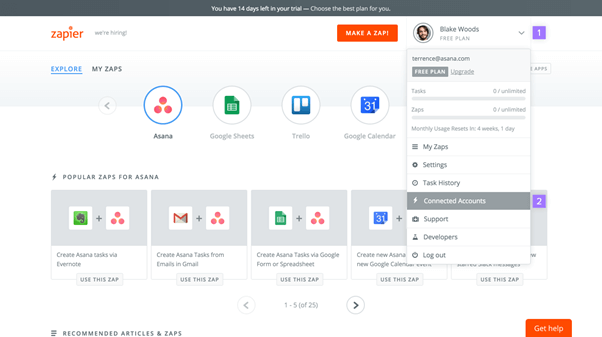

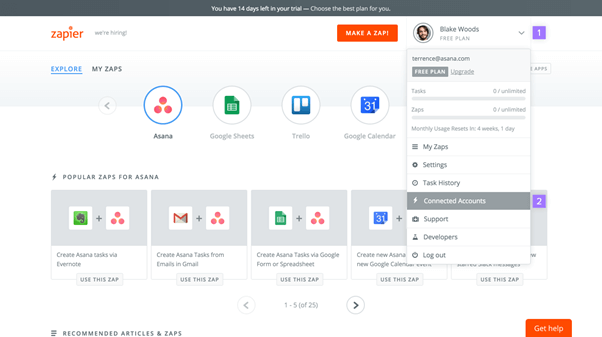

#9 Zapier

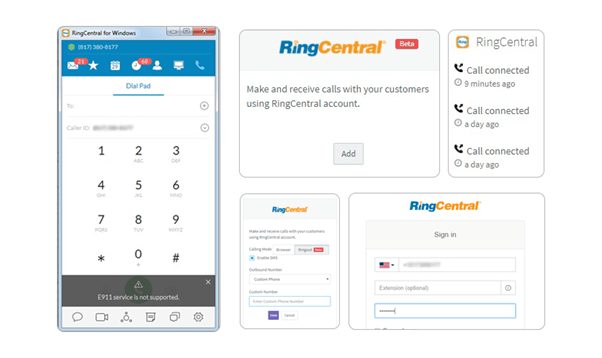

Few productivity apps are as fun and beneficial as this one. It has one purpose – to connect apps that you use for your business. While it supports a number of business apps, it appears more focused on online applications.

Some of the top names it supports include Gmail, Slack, and Dropbox. The tool can be a great time saver and is best for people who switch between a number of business apps. With this tool, you will be able to create workflows across several platforms.

Like most productivity apps discussed here, this one is free to use with some paid plans starting as low as $19.99 per month.

#10 Acuity Scheduling

Acuity Scheduling is a free scheduling app that makes it easy to schedule appointments. The tool can be a great pick for service providers such as dentists and lawyers. With this tool by your side, you will not have to rely on humans to schedule appointments and ensure slots are filled nearly.

It can reduce the need to send perpetual back and forth emails and send reminders or follow-ups via SMS or email to ensure your clients do not miss out on their appointments.

With this tool, you will be able to control your availability 24/7 as it works like a personal assistant and can even organize client information on your behalf.

While the basic tool is free to use, the company has some paid plans that come with advanced features. The cheapest plan starts as low as $14 per month.

#11 Focus@will

Focus@will is a focusing app that builds a sound profile based on your work. It is based on the theory that music can help you focus and stay productive.

The tool contains a collection of productive music that has been proven to be beneficial. The program chooses music based on your personality, work approach, and general work behavior.

Said to be one of the apps for business productivity, this service is suitable for people who work around a lot of distractions and find it difficult to focus on work. The paid app starts as low as $52.49 per year with the option to buy a lifetime license for $224.99.

#12 RescueTime

RescueTime is one of the best business apps designed to save time by allowing users to stay on track. Considered one of the top business apps, it comes with a central dashboard that can be set to yearly, weekly, or daily.

The best thing about this app is that it lets you track time spent offline as well as online. With this app, you will be able to create goals and see how close you are to achieving them and what needs to change to be more productive.

Those who want to remain productive can set notifications and alerts for goals reached. This trick can help people stay motivated. Moreover, there is also the option to block distracting websites to stay focused.

The tool comes with a free plan with the option to update for as low as $4.50 per month.

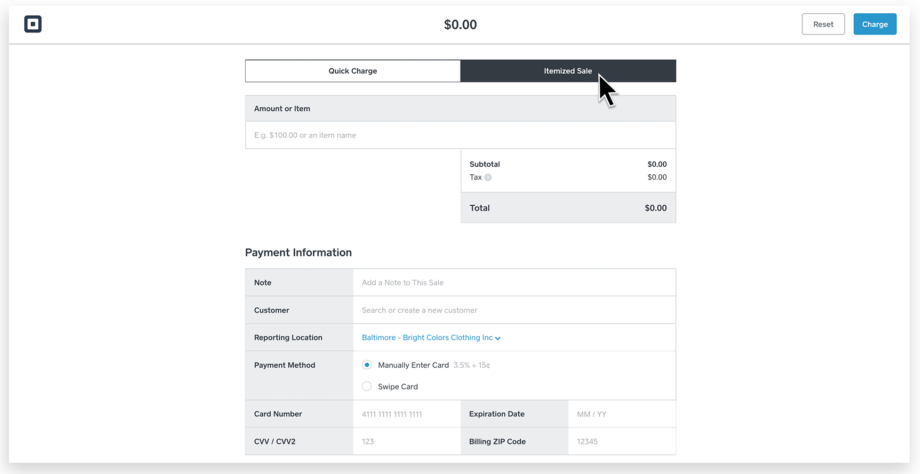

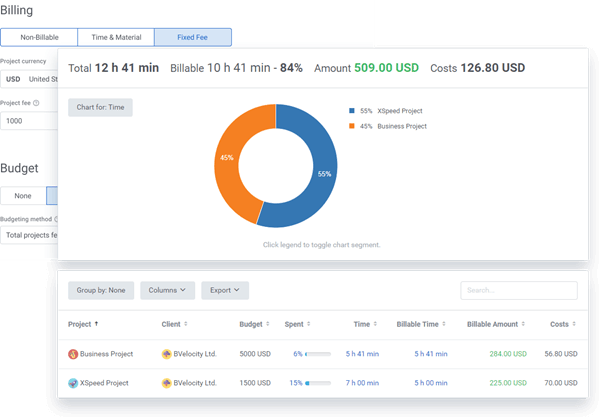

Apploye time tracking app is being used by numerous businesses to track their time, handle payroll, bill clients, document hours spent on various projects, monitor online timesheets, and run effective teams. You won’t have to worry about staff not reporting for work, wasting time, billing errors, chaotic project management, or improper payroll when you use Apploye TimeTrack Software.

Remote tracking feature of Apploye allows you to monitor screenshots, apps and URL usage of your employee.

Being one of the established market leaders in the time tracking app space, Apploye has excelled in a number of areas to win over business owners that value efficient processes, accurate timekeeping, and automatic worker monitoring.

Apploye provides four different pricing plans and you can always have trial free for 10 days before you grab a plan.

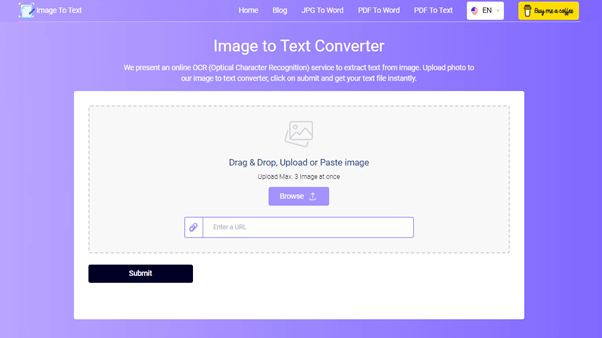

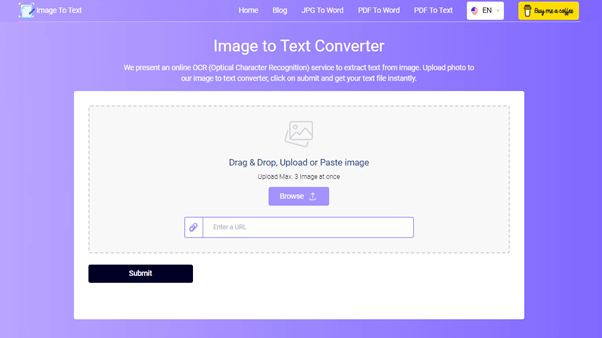

#14 Image To Text

When we talk about productivity apps, Imagetotext.info plays a key role for small businesses in managing documents. However, a tool to copy text from image is actually quite helpful for productivity.

Those who have to work with documents on a daily basis can appreciate this tool. There are many documents in a workplace that exist only as hard copies such as reports, receipts, invoices, and ID documents. However, in the modern day, most records are digital.

By using this Image To Text tool, people can automate the task of extracting the text from the image of a hard-form document and converting it into a digital format. This allows them to edit and save the documents in digital record rooms. Without a tool to copy text from the image, people had to manually transcribe documents into a digital format.

This online converter lets them extract text from the images and then can edit them to make necessary changes in the converted file without any hassle. That is a very time-taking task but it can be sped up by using an image-to-text converter. It is free to use and supports multiple image inputs for faster extraction. It is quite suitable for beginners and pros alike.

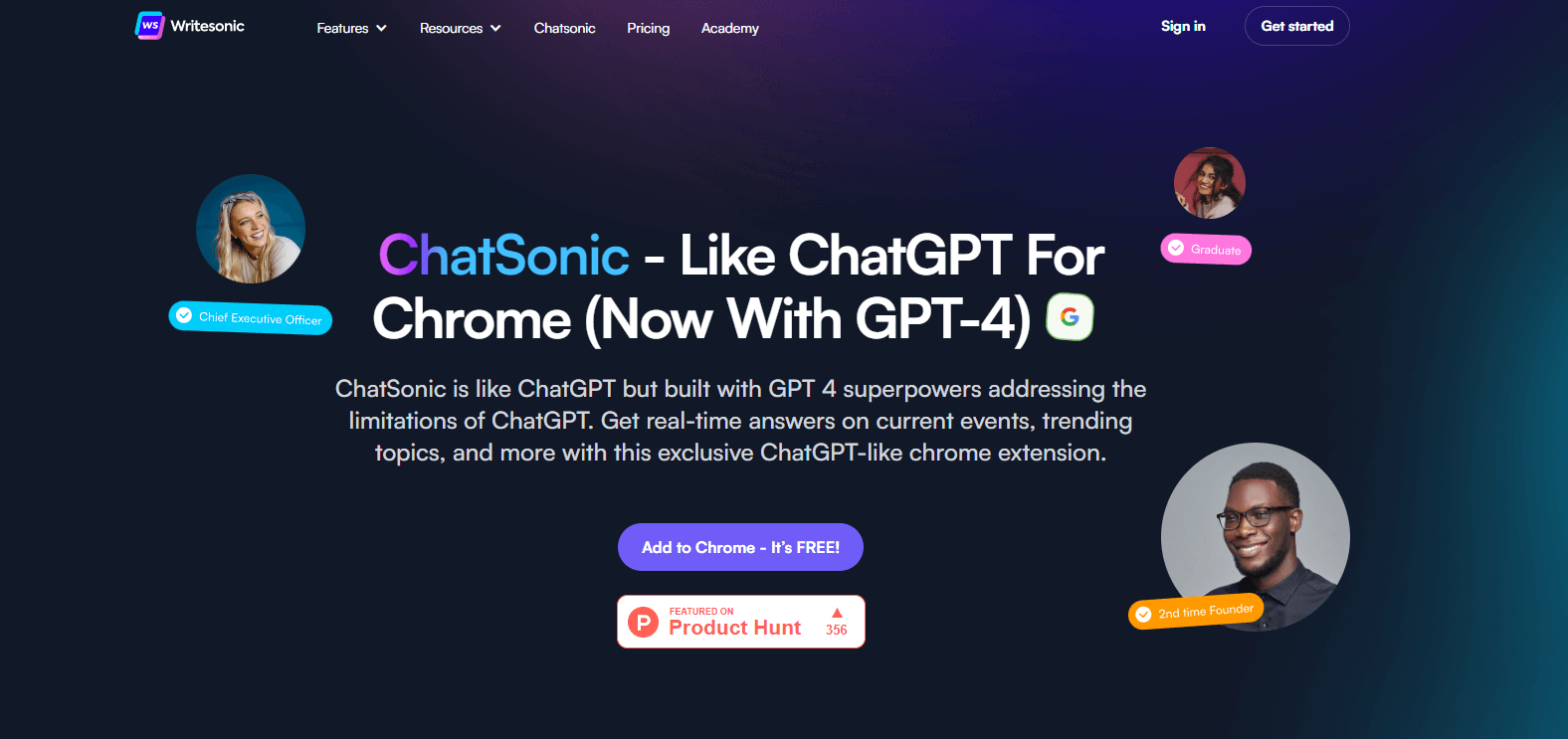

#15 ChatSonic

ChatSonic chrome extension is the ultimate productivity tool for Chrome users. It is an advanced ChatGPT-like Chrome extension designed to save you time and effort, and increase your productivity. With real-time data, voice command integration, and AI art generator capabilities, ChatSonic is the perfect extension for professionals who want to streamline their workflow and improve their output.

With ChatSonic, you can write from anywhere, get content suggestions without scouring the internet, generate summaries of long email threads, compose new LinkedIn posts, and generate ice-breakers to start a new conversation. The extension can also be used to boost productivity on social media and the web.

ChatSonic is trusted by over a million marketing teams, agencies, and startups, and is the perfect productivity tool for anyone looking to get ahead.

Apps for Business Productivity: Conclusion

These were some of the best business apps out there. Consider these if you are looking for apps for business productivity. While they all differ in terms of features, the aim of these best business apps is to help you save time and be more productive.

If you are looking for some extra productivity tools and apps we recommend taking a look at these 10:

1. Notion

2. Todoist

3. TickTick

4. Chanty

5. Harvest

6. Monitask

7. Loom

8. Twist

9. Cold Turkey Blocker

10. Hive