In 2023, freelancing has taken on a whole new level than ever before. Studies show that 73% of U.S. workers planned to freelance in 2023, and more than 72% of Gen Zers stated they plan to leave their jobs in 2023. With numbers like those, it should come as no surprise that freelancing is simply going off the charts.

With the flexibility to make your own hours and not having to report every move to your boss, freelancing certainly has its pros. However, setting up your business for success as a freelancer is key to its success.

Freelancing isn’t just deciding what service you want to offer, but it’s also setting up your business and implementing a business plan. Although neither task is difficult, they do require some work and are crucial to starting your business off on the right foot.

In this article, we will look at 6 mistakes freelancers make when setting up an LLC and what you can do to avoid making the same mistakes.

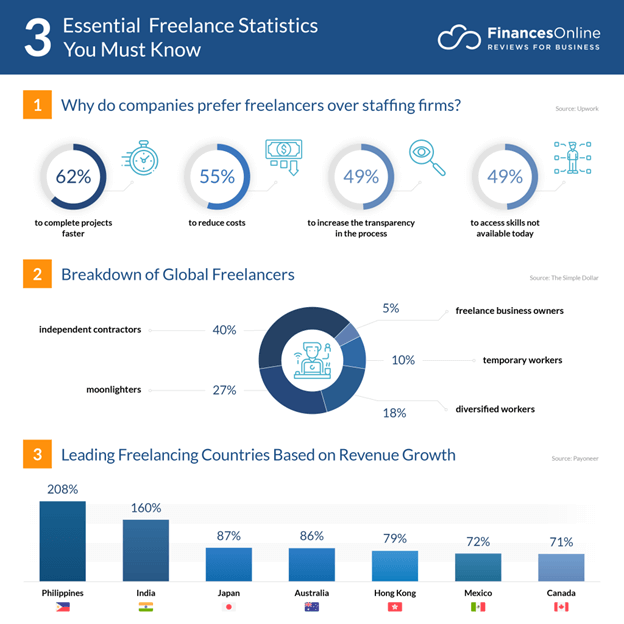

(Source: Financesonline.com)

Why Should you Set up an LLC?

Before we dive straight into mistakes freelancers make when setting up an LLC, let’s understand why you, as a freelancer, should go the extra mile to set up an LLC.

Setting up an LLC is popular for freelancers for more than one reason. The main reason is in the name—an LLC provides limited liability protection. Your personal assets are generally protected if your business faces legal action or debt. It separates your finances from your business obligations, shielding your personal assets from business liabilities. So if, for whatever reason, something happens to your business, your home and car would not be included as part of your company if you had set things up correctly when you made your LLC.

An LLC can also add credibility and professionalism to your freelance business. Clients might view an LLC as more trustworthy and established than someone who has not started their business off right.

Plus, if you plan to expand your freelancing business or hire employees or partners in the future, an LLC structure provides a solid framework for growth.

As you can see, setting up an LLC can benefit you in the long run, so be sure to start things off right from the get-go.

What Do you Need to Set up an LLC?

Although every state is different in what they require to set up an LLC, most states have a few things in common they require.

Here are some popular things states require that you should consider having in your hands when you prepare to file your LLC:

- Name of the LLC

- Name and address of the person filing for the LLC

- A valid email address

- Mailing address for the main office

- Name and address of the registered agent

- Name and address of each organizer

- A form of payment

Do Your Research and Go Against the Norm

Starting a freelance business is hard work. Sure, when you come up with the initial idea of what you want to do, you are inspired and ready to take on the world. Keep that inspiration and good energy, as you will need them to tap into it when business gets crazy.

As a new freelancer, don’t be afraid to go against the norm. For example, if you are a marketer, you probably tap into freelance tools that help you do your job better. This could be for anything from Mailchimp alternatives for newsletters, to the best platform to create free professional estimates for your business. Before committing to a certain platform, look into all the pros and cons of why one platform is more beneficial than others for your freelance business. You will probably be surprised with all the innovative options out there for freelancers.