What are the types of Profit and Loss Statements?

Profit and Loss Statements, also known as Income Statements, are financial documents that summarize a company’s revenues, expenses, and profits or losses over a specific period of time. There are various types of profit and loss statements tailored to different needs and audiences. Here are some common types:

Single-Step Profit and Loss Statement

- This type of statement is the simplest format, where all revenues are listed together and all expenses are listed together.

- It calculates the difference between total revenues and total expenses to determine the net income or net loss.

Multi-Step Profit and Loss Statement

- In this type, revenues and expenses are categorized into multiple sections, allowing for a more detailed analysis.

- It typically includes sections such as gross profit, operating income, and net income.

Contribution Margin Income Statement

- This statement separates costs into fixed and variable categories to calculate the contribution margin.

- It helps in analyzing the profitability of each product or service by focusing on the contribution margin, which is the difference between total sales revenue and total variable costs.

Common Size Profit and Loss Statement

- This type expresses each line item on the income statement as a percentage of total revenue.

- It helps in understanding the relative importance of different expense items and their impact on profitability.

Pro Forma Profit and Loss Statement

- A pro forma income statement is a projection of future revenues, expenses, and profits based on assumptions or hypothetical scenarios.

- It is often used for budgeting, forecasting, or presenting financial projections to investors or lenders.

Consolidated Profit and Loss Statement

- This statement combines the revenues, expenses, and profits or losses of multiple entities within a group of companies.

- It provides a comprehensive view of the financial performance of the entire group.

Comparative Profit and Loss Statement

- This type compares financial performance over different periods, such as month-over-month, quarter-over-quarter, or year-over-year.

- It helps in identifying trends, changes, and fluctuations in revenues, expenses, and profits over time.

Cash Flow Statement

- While not strictly a profit and loss statement, the cash flow statement tracks the flow of cash into and out of the business over a period of time.

- It provides insights into the liquidity and cash management of the company, which are essential for assessing its financial health.

Each type of profit and loss statement serves a different purpose and provides valuable insights into the financial performance of a business from various perspectives.

What does your Profit and Loss Statement include?

Your profit and loss statement focuses on two key areas: revenue and expenses. This enables you to work out the net income of your business by using the formula:

Net income = revenue – expenses

Revenue is the money your business has made during the accounting period covered by the income statement. It can be split into three key areas:

- Operating revenue – this is money made from the primary activity of your business, such as selling your products or services.

- Non-operating revenue – this is money made from secondary activities, such as rent from any properties your business owns, or interest on money you have in the bank.

- Gains – money made from other activities such as selling old company assets.

Business expenses are amounts of money which your business has paid out during the accounting period covered by the income statement. These can also be split into three areas:

- Primary expenses – these are expenses incurred in the primary activity of your business, such as staff wages, utility bills, research and development.

- Secondary expenses – these are expenses related to your business but not to its primary activities, such as interest payments on a business loan you have taken out.

- Losses – these are expenses which cause your business to lose money, such as legal costs in a court case, or selling an asset at a loss.

Putting all these figures down in a complete profit and loss statement template gives you a comprehensive overall picture of your business finances. For a start, it enables you to work out the net income of your business, so it effectively shows you the health of your finances.

However, it also shows you the finer details which are essential for making sound business decisions. Your profit and loss statement can show you how competitive your business is against others in the same field, and how well you are using your available capital to increase your business activities.

This information feeds into your major financial decisions, helping you to set realistic budgets and make wise investments so you can improve the success and profitability of your business.

What is not included in your Profit and Loss Statement?

Your income statement is not a statement of cash flow. This means it does not include receipts or cash payments; in other words, money received or paid out by your business. There is a good reason for this: your income statement needs to refer to a particular accounting period, and your revenue and expenses have to balance. Payments and receipts are often not completed within the same period as each other, so they cannot be accounted for until they can balance.

Example:

In January, your business spends $10,000 buying 100 stock items at $100 each, which it plans to sell on for $120 each. However, you only sell 20 of these items in January. This means you would only be able to include the expenditure for 20 items in your January accounts, in order to ensure that they balance. Therefore your cash payments for January would be $2,000 and your receipts would be $2,400.

You then sell the remaining 80 items in February, so you would have to show the expenditure for those in your February accounts, as well as the receipts. Your cash payments for February would therefore be $8,000, and your receipts would be $9,600.

It would be impractical to include receipts and cash payments in your income statements, as this disparity happens so regularly for most businesses. Perhaps the business does not sell off their stock within the same accounting period as the purchase.

Maybe clients are late paying their invoices. Or it could be one of a wide range of other circumstances that can arise, any of which can mean that the accounts for that period do not balance. Figures should not be included in your profit and loss statement until your revenue and expenses can balance.

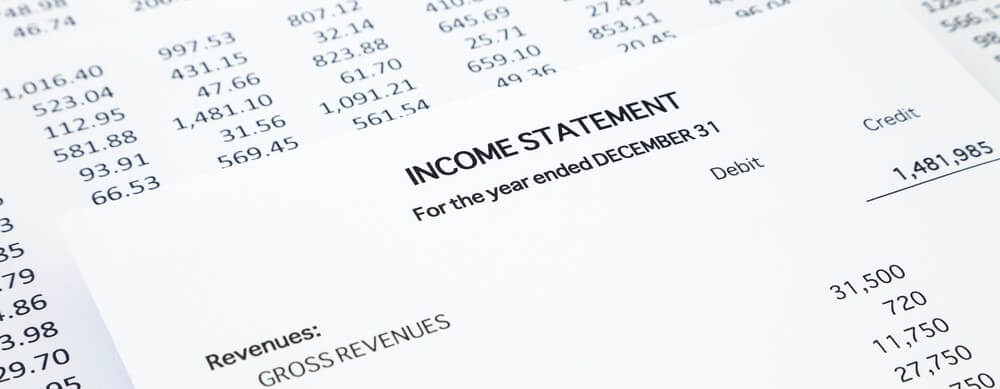

What does an Profit and Loss Statement look like?

No two businesses’ income statements will look exactly the same, but the information they contain tends to be fairly similar. If you look at a profit and loss statement sample from any business, you can see the type of information most income statements contain, and yours will probably not look too different.

However, it is important not to use another company’s income statement as a profit loss template for your own business, as it will not be entirely appropriate for your individual needs.