Smart Invoicing Feature

Small Business Expense Tracking

Every Expense Counted, Every Receipt Saved

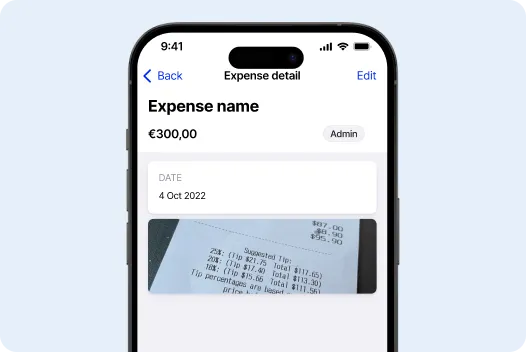

Easily track your business expenses with smart expense tracking software. Snap receipts, categorize spending, and stay organized—all in one place. Get real-time insights into your cash flow and never lose track of a single expense.

Save time with automated expense tracking and seamless reporting. Whether you're on the go or at your desk, managing expenses has never been easier.

No time for paperwork? Billdu tracks expenses for you!

Master your expenses, track every dollar spent. Enjoy all-in-one expense management software and receipt scanner at your fingertips.

Tired of losing receipts and tracking expenses manually? You’re not alone. Disorganized finances can cost you money, time, and cause unnecessary stress.

With Billdu’s expense tracker and receipt scanner, managing expenses is effortless. Snap receipts on the go, categorize expenses automatically, and keep everything organized.

Not sure if expense tracking software is right for you? Let us give you more reasons.

With the simple app, work smarter, not harder.

Get paid up to 9 days sooner.

Billdu simplifies business tracking on mobile and web.

For small businesses, Billdu keeps your business organized and accessible. For larger teams, advanced features help your business scale easily.

Grow your business with team effort. Invite all members onboard.

Get notified when exactly an invoice was opened and viewed.

Stay in control with clear, easy-to-understand financial reports.

Invite your accountant to the team and focus on growing your business.

Get paid instantly with quick and secure online payments.

Impress clients with professional invoices. Select a template and pick your business color.

Expense tracking means knowing where your money goes. It helps you spend smarter and save more.

Say you're a contractor—you buy materials, pay for gas, grab a coffee. Without tracking, you might overspend. With an app or notebook, you see every cost and stay in control.

Want to make it easy? Try the invoicing app Billdu for Android or iPhone!

Yes, for entrepreneurs and contractors, tracking expenses is a must.

You deal with material costs, fuel, client lunches—small expenses add up fast. Without tracking, you might overspend or miss tax deductions. With it, you stay profitable, organized, and ready for tax season.

Tracking expenses is easy with the right method. Here are three simple ways:

1. Use Excel or Google Sheets – Create a table with date, category, amount, and payment method. Update it regularly.

2. Use an Expense Tracker App – Automates tracking, scans receipts, and categorizes expenses for you.

3. Use a Business Bank Account – Keep personal and business expenses separate. Many banks offer built-in tracking tools.

Pick what works best and stay on top of your finances!

Creating an expense sheet for a small business is simple. Here’s how:

1. Choose a Format – Use Excel, Google Sheets, or accounting software.

2. List Expense Categories – Rent, supplies, fuel, tools, meals, etc.

3. Add Columns – Date, description, amount, payment method, and category.

4. Record Every Expense – Enter details daily or weekly to stay accurate.

5. Total Your Expenses – Sum up costs to see where your money goes.

6. Review & Adjust – Identify overspending and find ways to save.

Keeping it updated helps you manage cash flow and prepare for taxes! A better alternative is invoicing software for small businesses, which tracks expenses automatically and saves you time.

Creating a simple balance sheet for a small business is easy. Follow these steps:

List Your Assets – Cash, equipment, inventory, accounts receivable (money owed to you).

List Your Liabilities – Loans, credit card debt, accounts payable (money you owe).

Calculate Equity – Assets minus liabilities = your business’s net worth.

Use a Simple Format – A spreadsheet with three sections: Assets | Liabilities | Equity.

Update Regularly – Monthly or quarterly to track financial health.

A balance sheet helps you see where your business stands. For a faster, automated solution, invoicing app can generate financial reports for you.

You can upload expenses manually by entering details in a spreadsheet or expense tracker. Another option is to scan receipts using an app that records the details automatically. You can also import transactions by connecting your bank or uploading a statement.

Expense tracking app costs vary. On average, basic plans range from $5 to $15 per month, while advanced features can cost $20 or more.

Billdu offers flexible pricing with a 30-day free trial. Plans start at an affordable monthly rate, with options for freelancers and small businesses. You get expense tracking, invoicing, receipt scanning, and more—all in one app. Billdu starts at just $4.99/month with annual billing.

Simple Invoicing Platform for Freelancers and Small Businesses